Yesterday, during a meeting with CEOs of US steel and aluminum manufacturers, Donald Trump caught the world’s attention after he threatened to slap a 25% tariff on steel imports and a 10% tariff on aluminum. How soon would he move on the measures? “Next week,” Trump said. “What’s been allowed to go on for decades is disgraceful. It’s disgraceful,” he reiterated.

Today, Trump followed up the threat with a tweet that hints he might go even further.

When a country Taxes our products coming in at, say, 50%, and we Tax the same product coming into our country at ZERO, not fair or smart. We will soon be starting RECIPROCAL TAXES so that we will charge the same thing as they charge us. $800 Billion Trade Deficit-have no choice!

— Donald J. Trump (@realDonaldTrump) 2 March 2018

With the European Union already saying they would retaliate with protectionist measures of their own, the action could spark an international trade war and have implications that go far beyond the knife industry. But, we wondered how a possible tariff on steel on the immediate horizon might affect knife companies and the price of knives for consumers.

Knife makers tell us that blade steel can represent upwards of 25% of the materials costs that go into making a knife. But, Elliot Williamson, Co-Founder of Ferrum Forge explains that in the short-term, an increase in the cost of steel is more likely to have an impact on bigger US knife manufacturers like Spyderco, Benchmade, and KAI-USA than custom makers and small batch shops. “As a percentage of the total cost of a knife, the cost of the steel itself has less of an impact on the overall price of the knife,” Williamson explains. “Most of the cost of a custom knife is coming from the time input of the maker.”

We also reached out to Scott Devanna, Vice President of Technology for steel distributor SB Specialty Metals for his reaction to the news. “It’s hard to predict to what degree this would impact steel prices. There’s a lot we don’t know,” he tells us. “You have to realize that the knife industry’s demand for steel is minuscule compared to other industries. It’s a drop in the bucket.”

A veteran of the steel industry, Devanna says that as the costs of imported steels like Bohler M390 and Sandvik go up it could also drive up the prices of domestic steels as major buyers in power generation, aerospace, and oil patch transition to more American made steel. “It’s possible American steel makers would see this as an opportunity to raise prices. It’s a balancing act,” he says.

Devanna tells us that if there was a run on domestic steel it could stretch out lead times, but he’s not concerned about the availability of steel for knife manufacturers. “The team of Crucible Industries and Niagara Specialty Metals should be able to handle any kind of shift in demand.”

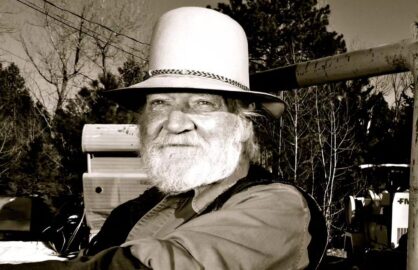

Knife featured in image: Zero Tolerance 0393

You may also like...

Featured

Design Minds

Shop Talk: 7Forge Knives Goes from Science Project to Semi-Production

October 24, 2024In the last five years, the knife making scene has absolutely exploded, with dozens upon dozens of new names, new talents, and new knives. One shop that gained a...

Grant Hawk Passes Away at 82

November 15, 2023Hawk Knives delivered deeply sad news to the knife world yesterday: Grant Hawk, one of the most innovative, boundary-pushing knife makers of the 20th century, passed away earlier this...

Latest News

TOPS and OKC Team Up for New Version of Old Favorite

February 16, 2026Last in our recent spate of TOPS coverage is the Ontario XL Hunter. Whereas the last few new for 2026 TOPS pieces were in-house designs, the Ontario XL Hunter...

We Knife Co. Remains Nivron the Ball

February 13, 2026What’s cleaner than clean? We Knife Co. is trying to answer that question with an incoming model called the Nivron, which brings a look that can only be described...

Boker Joins Modern Club Knife Club

February 12, 2026Boker has once again renovated a traditional pocket knife for 2026. The Modern Club Knife is another historic jack knife pattern spruced up with all the modern EDC knife...

El Chete Family Grows Again This Year

February 11, 2026TOPS is continuing its shrinking-down of famous models with the Lil Chete. As the name implies, the Lil Chete brings the famous big chopper’s design into a smaller –...

RoseCraft Inducts 14C28N into Traditional Lineup

February 9, 2026RoseCraft’s newest model, the Barren Fork Jack, has just arrived with dealers – and it marks a big moment for the shop as it is the first RoseCraft piece...

Facebook

ABOUT KnifeNews

KnifeNews delivers today's news for knife people like us. We report the latest news on new and popular knives, production knife companies, custom makers, innovations, and cover topics that are of interest to the knife carrying community.

LATEST

Tags

featured Knives Benchmade Spyderco Boker Civivi We Knife Co. CRKT Sponsored TOPS knife business Kizer Kershaw Survey Zero Tolerance Kickstarter Work Sharp KnifeCenter.com Buck Bestech Nick Shabazz Knife Gripes Readers' Choice Awards KA-BAR Cold Steel Ostap Hel SOG Design minds GiantMouse KnivesShipFree Victorinox Gerber Interest New for 2017 Urban EDC Supply Jesper Voxnaes Real Steel LionSteel Knife companies Dealers' Choice Awards

©knifenews.com 2022

0 comments